Cloud-Based Accounting Software for Small Businesses in UAE: A Comprehensive Guide

As a small business owner in UAE, managing your finances can be a daunting task, especially when you don’t have the right tools. With the advancements in technology, accounting software has become an essential tool for small businesses. In this article, we will take a look at the best accounting software for small businesses in UAE.

Table of Contents

What is Cloud-based Accounting Software?

Cloud-based accounting software is a type of accounting software that is hosted on remote servers and accessed through the Internet. This means that users can access their accounting data from anywhere with an internet connection, using any device, such as a desktop computer, laptop, or mobile device.

Benefits of Accounting Software for Small Businesses

There are several benefits of using accounting software for small businesses, including:

1. Time-Saving

Accounting software can save you time by automating manual processes. For example, you can automatically generate invoices and receipts, saving you the time you would have spent creating them manually.

2. Increased Accuracy

Accounting software can also help you increase accuracy in your financial transactions. The software can help you avoid mistakes that may arise from manual processing of financial transactions.

3. Improved Financial Reporting

With accounting software, you can generate financial reports in real-time, allowing you to make informed decisions about your business.

4. Enhanced Security

Accounting software can also enhance the security of your financial transactions. You can set up the software to restrict access to financial data, ensuring that only authorized personnel have access to the data.

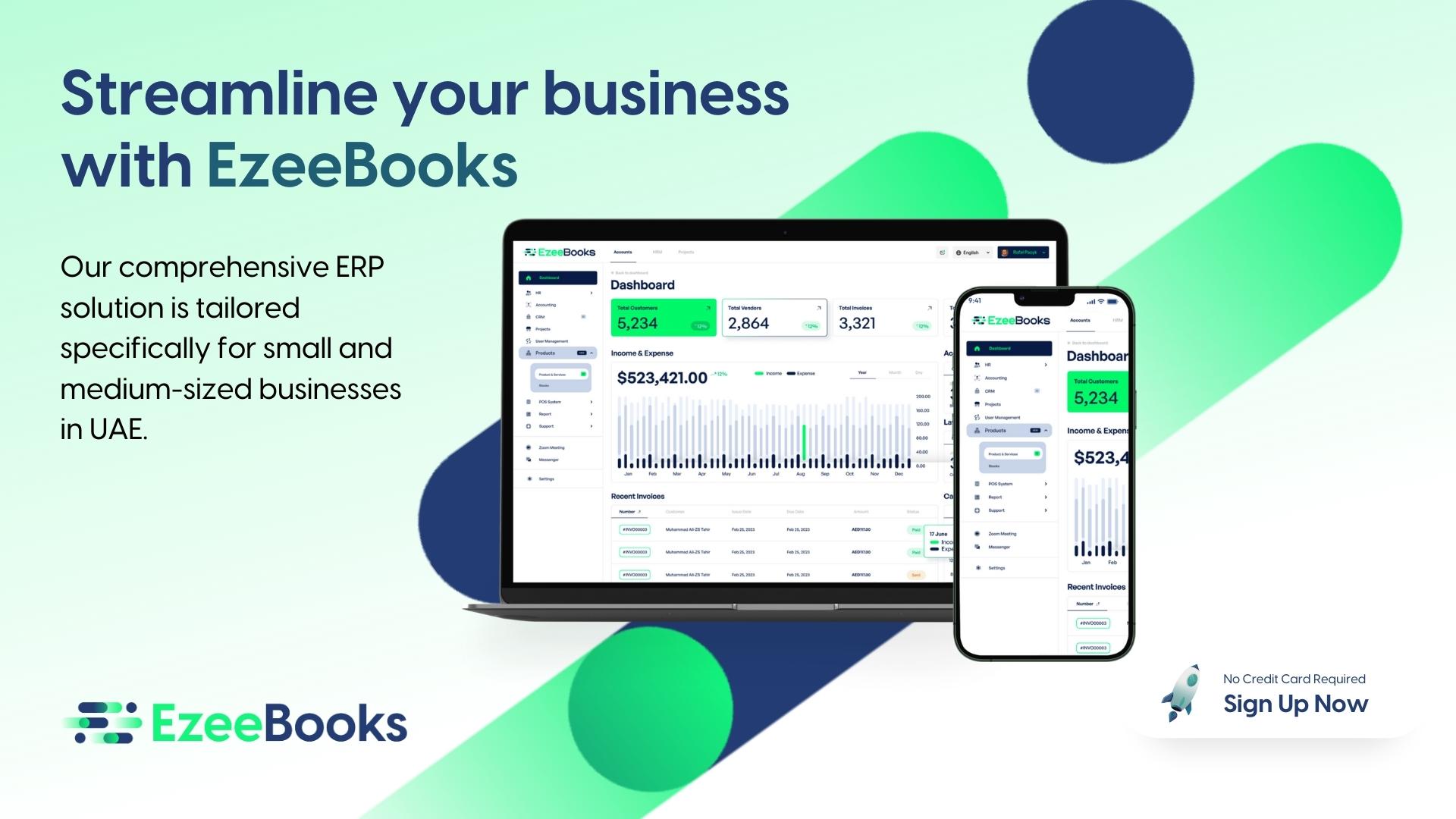

Ezeebooks is one of the best cloud-based Accounting Software for Small Businesses in the UAE

Ezeebooks is a popular accounting software that is considered one of the best options for small businesses in the UAE. It provides an easy-to-use and efficient solution for managing financial transactions and records.

One of the key benefits of using Ezeebooks is its ability to automate many financial processes, such as invoicing, billing, and payment processing. This can save small business owners a significant amount of time and effort, allowing them to focus on other important aspects of their business.

Additionally, Ezeebooks is designed to be user-friendly, with an intuitive interface and easy-to-navigate menus. This makes it a great option for small business owners who may not have extensive experience with accounting or financial management.

Overall, if you’re looking for reliable and efficient accounting software for your small business in the UAE, Ezeebooks is worth considering.

Factors to Consider When Choosing Accounting Software

When choosing accounting software for your small business in UAE, here are some factors to consider:

1. Features

Consider the features offered by the software and ensure that they meet your business needs.

2. Pricing

Consider the pricing model of the software and ensure that it is within your budget.

3. User-Friendliness

Consider how user-friendly the software is and ensure that it is easy to use.

4. Integration

Consider whether the software integrates with other business tools you use, such as payroll and CRM systems.

Conclusion

Accounting software is an essential tool for small businesses in UAE. It can help you manage your finances more efficiently, save time, and make informed decisions about your business.

When choosing accounting software for your small business in UAE, it’s important to consider factors such as features, pricing, user-friendliness, and integration with other business tools. With the variety of options available, it’s crucial to assess each software’s strengths and weaknesses before making a decision.

It’s also essential to note that while accounting software can help streamline financial processes, it doesn’t replace the need for a professional accountant. Hiring a qualified accountant can provide additional benefits such as expert financial advice, tax planning, and compliance with legal requirements.

In conclusion, accounting software is a valuable tool for small businesses in UAE. With the right software, you can save time, increase accuracy, and make informed decisions about your business. However, it’s important to consider all factors when choosing accounting software and to also seek the guidance of a qualified accountant.

FAQs

1. Is accounting software necessary for small businesses in UAE?

- Yes, accounting software can help small businesses manage their finances more efficiently and make informed decisions.

2. What factors should I consider when choosing accounting software?

- Features, pricing, user-friendliness, and integration with other business tools are important factors to consider.

3. Can accounting software replace the need for a professional accountant?

- No, while accounting software can help streamline financial processes, a professional accountant can provide additional benefits such as expert financial advice and tax planning.

4. Are there any free accounting software options for small businesses?

- Yes, there are some free accounting software options available such as Wave and GnuCash.

5. Can accounting software help with tax compliance?

- Yes, some accounting software can assist with tax compliance by generating reports and providing reminders for tax deadlines.